Supply chain risk management issues span economic volatility, supplier vulnerabilities, environmental threats, cybersecurity breaches, and geopolitical instability. Each category demands distinct mitigation strategies. financial risks involve currency fluctuations and cost pressures. Supplier risks include quality failures and capacity constraints. Environmental risks encompass natural disasters and climate-related disruptions. Cybersecurity threats target digital systems and data integrity. Geopolitical risks emerge from tariffs, trade restrictions, and regulatory changes.

Effective supply chain risk management requires systematic identification, assessment, and mitigation across all categories. Organizations must build resilience through supplier diversification, enhanced visibility, robust business continuity planning, and proactive monitoring systems.

The current environment presents unprecedented complexity. Recent analysis finds that tariffs are a top-of-mind concern for supply chain leaders in 2025, with 82% of surveyed companies reporting their supply chains are affected by new tariffs. This single statistic reveals how rapidly external forces can reshape operational priorities.

My work in transport compliance and supply chain safety spans multiple sectors. The risks I’ve observed differ significantly across industries, yet common patterns emerge. Manufacturing clients face different supplier vulnerabilities than retail organizations, but both share exposure to transportation disruptions and regulatory changes.

This guide examines the major supply chain risk categories, provides frameworks for assessment, and outlines practical mitigation strategies. You’ll understand how to identify vulnerabilities specific to your operations, prioritize risks based on impact and likelihood, and implement targeted controls that strengthen resilience without creating operational bottlenecks.

What Supply Chain Risk Management Actually Means

Supply chain risk management involves identifying potential disruptions, assessing their likelihood and impact, and implementing controls to minimize negative consequences. This systematic approach protects operational continuity, financial stability, and customer relationships.

SCRM differs from general business risk management through its focus on interconnected networks. A single supplier failure can cascade through multiple production stages. A port closure in one region can disrupt operations globally. This interconnectedness demands visibility across the entire supply chain, not just direct relationships.

The discipline encompasses several core activities:

- Risk identification through supply chain mapping and vulnerability assessment

- Impact analysis that quantifies potential financial and operational consequences

- Mitigation strategy development aligned with business priorities

- Continuous monitoring through performance metrics and early warning systems

- Incident response planning with clear escalation protocols and recovery procedures

Practitioners and experts now emphasize that resilience and agility are no longer optional but the foundation of competitive advantage. This represents a fundamental shift from viewing supply chain risk management as compliance overhead to recognizing it as strategic capability.

The Shift from Reactive to Proactive Management

Traditional approaches addressed supply chain disruption after occurrence. Modern SCRM emphasizes prediction and prevention. This shift requires different capabilities, technologies, and organizational structures.

Proactive management relies on data analytics, scenario planning, and continuous risk assessment. Organizations monitor leading indicators rather than waiting for disruptions to occur. They model potential scenarios and develop response plans before crises emerge.

This approach delivers measurable benefits. Organizations reduce downtime, maintain customer service levels during disruptions, and recover faster when incidents occur. They also identify opportunities that competitors miss, such as alternative sourcing strategies that provide cost advantages alongside risk reduction.

Understanding Risk Tolerance and Appetite

Effective supply chain risk management aligns with organizational risk tolerance. Not all risks require identical responses. Some organizations accept higher risk levels in exchange for cost advantages. Others prioritize stability over efficiency.

Risk appetite varies by industry, market position, and strategic objectives. A luxury goods manufacturer might accept higher supplier costs to ensure quality consistency. A discount retailer might tolerate occasional stockouts to minimize inventory investment.

The key lies in making conscious choices rather than accepting risks by default. Document your risk tolerance explicitly. Ensure mitigation strategies align with stated priorities. Review these decisions regularly as business conditions change.

Why Supply Chain Risk Management Matters More Than Ever

Global, highly complex supply chains are constantly under threat from disruptions at every stage of the product lifecycle. This reality makes systematic risk management essential for operational survival, not merely competitive advantage.

Modern supply chains face additional pressure from rising transportation and logistics costs, labor constraints, and changing customer expectations. These factors compound existing vulnerabilities while creating new categories of risk.

Organizations that neglect supply chain risk management face predictable consequences. Supply chain disruption damages customer relationships through delivery failures and quality inconsistencies. Financial risk materializes through inventory writeoffs, expedited freight charges, and lost revenue. Regulatory exposure increases when compliance failures emerge during crisis response.

The Financial Impact of Supply Chain Disruption

Supply chain disruption creates direct and indirect financial consequences. Direct costs include expedited shipping, alternative sourcing premiums, and production downtime. These expenses are measurable and immediate.

Indirect costs often exceed direct impacts. Customer defection to competitors, damaged brand reputation, and reduced investor confidence create lasting financial harm. Recovery can take quarters or years depending on disruption severity.

The calculation extends beyond immediate response costs. Organizations must consider opportunity costs from missed market opportunities, strategic costs from damaged supplier relationships, and compliance costs from regulatory investigations triggered by disruptions.

Competitive Implications of Risk Management Capability

Supply chain resilience increasingly differentiates market leaders from followers. Organizations with robust risk management maintain service levels during industry-wide disruptions. They capture market share from competitors struggling with operational failures.

This competitive advantage compounds over time. Customers remember which suppliers maintained reliability during crises. They structure future relationships accordingly. Investors recognize the value of operational stability and price equity appropriately.

The capability also enables strategic flexibility. Organizations confident in their risk management can pursue opportunities that more vulnerable competitors avoid. They enter new markets, adopt novel technologies, and optimize operations without fear of catastrophic failures.

The Four Main Categories of Supply Chain Risks

Supply chain risk falls into four primary categories. This framework provides structure for risk assessment and mitigation planning. Understanding these categories helps organizations allocate resources effectively and develop targeted controls.

The categories are not mutually exclusive. Many disruptions involve multiple risk types simultaneously. A natural disaster creates operational risk through facility damage, supplier risk through production interruption, and financial risk through recovery costs. Effective mitigation strategies address these intersections.

| Risk Category | Primary Characteristics | Common Triggers |

|---|---|---|

| Operational Risks | Internal process failures, capacity constraints, quality issues | Equipment malfunctions, human error, inadequate procedures |

| Supply Risks | Supplier performance failures, material shortages, dependency vulnerabilities | Supplier bankruptcy, quality failures, single-source dependencies |

| Demand Risks | Forecast inaccuracy, market volatility, customer behavior shifts | Economic changes, competitive actions, preference shifts |

| Environmental Risks | External events beyond organizational control | Natural disasters, geopolitical events, regulatory changes |

How Risk Categories Interact and Compound

The most severe supply chain disruptions result from cascading failures across multiple risk categories. A geopolitical event triggers supplier failure, which creates operational constraints, which leads to demand fulfillment problems.

Understanding these interactions improves mitigation strategy design. Controls that address single risk categories may prove inadequate during compound events. Effective strategies build resilience across multiple categories simultaneously.

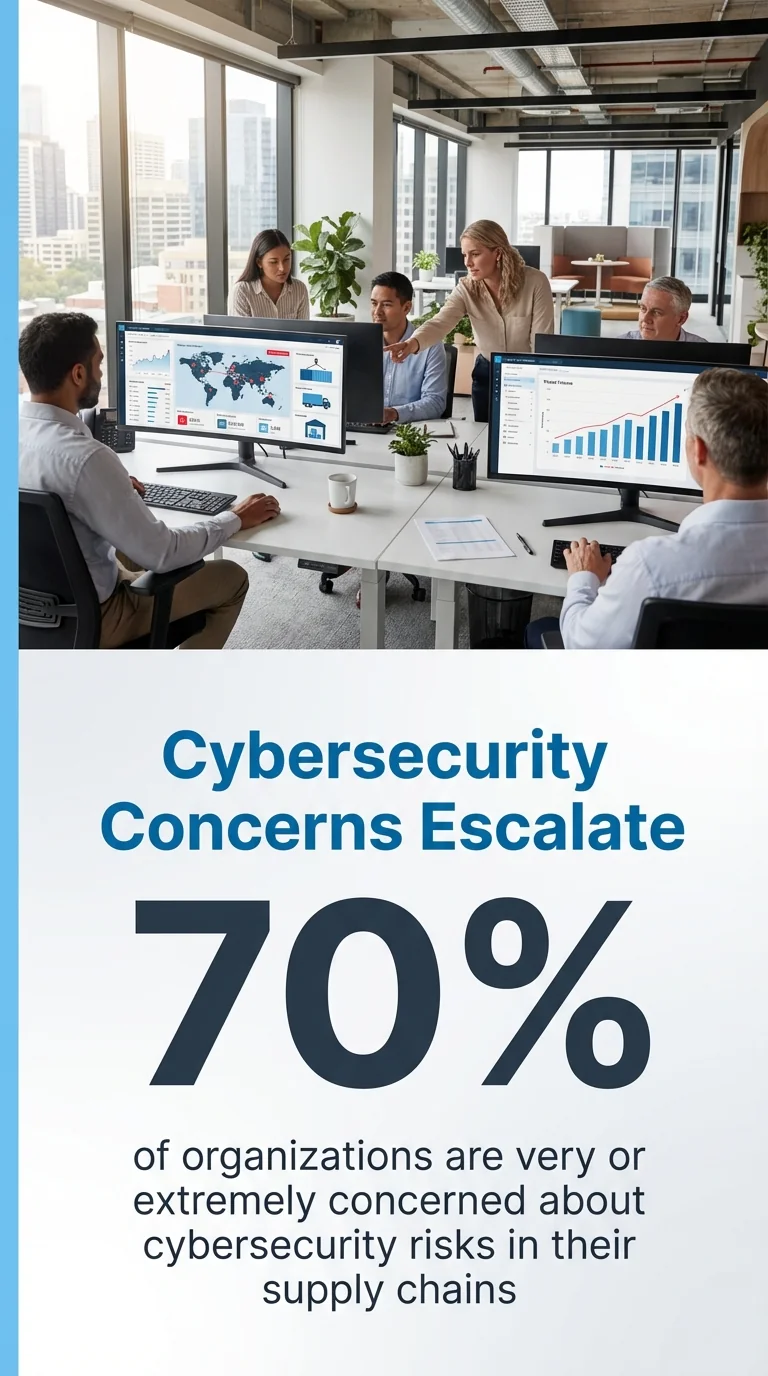

Consider how cybersecurity breaches illustrate this dynamic. In a global survey on supply chain cyber risk, 70% of respondents said their organizations are very or extremely concerned about cybersecurity risks in their supply chains. This concern reflects how digital attacks create operational disruption, supplier relationship damage, and financial impact simultaneously.

Economic and Financial Risks

Economic and financial risks stem from currency fluctuations, inflation pressures, credit availability, and cost volatility. These factors affect procurement costs, working capital requirements, and profit margins. Organizations must monitor economic indicators and develop hedging strategies.

Currency volatility creates particular challenges for global supply chains. Exchange rate movements can eliminate profit margins on international transactions. Organizations with mismatched currency exposures face ongoing financial risk regardless of operational performance.

Inflation affects different supply chain elements unevenly. Transportation costs, raw materials, and labor rates respond to inflationary pressure at different rates. This uneven impact complicates forecasting and budgeting processes.

Supplier Financial Instability

Supplier financial health directly impacts supply chain resilience. Suppliers facing cash flow problems may cut quality corners, delay deliveries, or cease operations entirely. Early detection of supplier financial distress enables proactive mitigation.

Monitor key financial indicators for critical suppliers. Payment terms changes, delivery delays, and quality degradation often signal financial problems before formal insolvency proceedings begin. Diversify sourcing for suppliers showing financial weakness.

The challenge intensifies in tiered supply chains. Your direct supplier may appear financially stable while their subcontractors face insolvency. Visibility beyond first-tier suppliers helps identify these hidden vulnerabilities.

Cost Inflation and Price Volatility

Commodity price volatility affects manufacturing costs, transportation expenses, and packaging materials. Organizations must develop strategies to absorb or pass through cost increases while maintaining competitive positioning.

Fixed-price contracts create financial risk during inflationary periods. Suppliers may default on contracts when costs exceed anticipated levels. Balance contract terms to share risk appropriately between buyers and suppliers.

Develop forecasting capabilities that anticipate cost movements rather than reacting after increases occur. Monitor leading indicators specific to your supply chain. Build cost escalation clauses into long-term agreements.

Mitigation Strategies for Economic Risks

Implement currency hedging for significant international transactions. Natural hedges through matched revenue and cost currencies provide structural protection. Financial hedges through forward contracts or options address residual exposures.

Diversify supplier base across geographic regions and economic zones. This geographic diversification reduces exposure to regional economic downturns while creating sourcing flexibility during cost inflation.

Develop cost models that identify key drivers and sensitivities. Update these models regularly as market conditions change. Use scenario analysis to stress-test supply chain economics under adverse conditions.

Geopolitical and Political Risks

Geopolitical risk encompasses trade policies, tariffs, sanctions, political instability, and international conflicts. These factors can disrupt supply chains through direct prohibition of trade, increased costs through duties, or physical disruption of logistics networks.

Trade policy changes create immediate operational challenges. New tariffs alter cost structures overnight. Regulatory requirements for country-of-origin documentation or content restrictions force product redesigns. Organizations must monitor policy developments and maintain flexibility to adapt quickly.

Political instability affects supplier operations and logistics networks. Civil unrest can close ports, restrict transportation, and damage infrastructure. Political transitions may bring regulatory changes or resource nationalization that disrupts established supply relationships.

Tariff and Trade Barrier Impacts

Tariffs directly increase import costs and may make existing sourcing strategies economically nonviable. Organizations must evaluate alternative sourcing locations, domestic production options, or product redesigns to eliminate affected components.

Trade barriers extend beyond simple tariffs. Quota systems, licensing requirements, and technical standards can effectively prohibit imports regardless of willingness to pay duties. These non-tariff barriers often prove more disruptive than straightforward tariffs.

Develop sourcing strategies that maintain flexibility across multiple countries and regions. The optimal approach balances cost efficiency with geopolitical diversification. Avoid concentration in single countries or economic zones regardless of current cost advantages.

Sanctions and Export Controls

Sanctions prohibit transactions with specific countries, organizations, or individuals. Export controls restrict technology transfer and product shipments. Violations carry severe penalties including criminal prosecution, civil fines, and loss of export privileges.

Compliance requires systematic screening of suppliers, customers, and logistics providers against sanctions lists. Effective strategies for managing supply chain risks must include robust compliance programs that detect prohibited parties before transactions occur.

The complexity increases with transshipment and indirect channels. Components may pass through multiple countries before reaching final destinations. Software may be incorporated into products exported to prohibited destinations. Map complete supply chains to identify compliance vulnerabilities.

Political Risk Assessment and Response

Assess political risk systematically for countries where you maintain significant operations or sourcing relationships. Consider government stability, regulatory predictability, corruption levels, and infrastructure reliability.

Develop contingency plans for deteriorating political situations. Identify alternative suppliers, logistics routes, and production locations before crises emerge. Maintain relationships that can be activated quickly when primary options fail.

Consider political risk insurance for major investments in volatile regions. These policies provide financial protection against expropriation, currency inconvertibility, and political violence. Balance insurance costs against potential losses and strategic importance of locations.

Environmental and Natural Disaster Risks

Environmental risks include natural disasters, extreme weather, climate change impacts, and environmental regulations. These factors can damage facilities, disrupt transportation networks, and create regulatory compliance obligations.

Natural disasters strike with limited warning and create widespread disruption. Earthquakes, hurricanes, floods, and wildfires damage infrastructure and halt operations. Organizations must identify geographic vulnerabilities and develop response capabilities.

Climate change increases the frequency and severity of extreme weather events. Traditional risk models based on historical patterns may underestimate future exposure. Organizations must adapt assessment methodologies to account for changing environmental conditions.

Geographic Concentration and Natural Disaster Exposure

Geographic concentration creates vulnerability to regional disasters. Single-source suppliers, facilities concentrated in disaster-prone regions, and transportation routes through high-risk areas all represent potential failure points.

Map supply chain facilities and transportation networks against natural disaster risk zones. Identify concentration areas where earthquakes, hurricanes, or floods could disrupt operations. Develop geographic diversification strategies that reduce exposure.

Consider both direct and indirect exposure. Your facility may sit outside disaster zones while critical suppliers or logistics nodes lie within high-risk areas. Complete supply chain mapping reveals these hidden vulnerabilities.

Climate Change and Long-Term Environmental Shifts

Climate change creates gradual shifts in operating environments alongside increased extreme weather frequency. Rising sea levels threaten coastal facilities and ports. Changing precipitation patterns affect agriculture-dependent supply chains. Temperature increases stress logistics infrastructure and worker productivity.

Assess long-term climate projections for critical facility locations and supplier operations. Consider whether current locations remain viable under projected conditions. Plan facility investments and long-term supplier relationships accordingly.

Develop adaptation strategies that address both gradual changes and acute events. Heat-resistant infrastructure, water conservation systems, and backup power generation protect against environmental shifts while building resilience against extreme events.

Environmental Compliance and Sustainability Requirements

Environmental regulations increasingly affect supply chain operations. Emissions standards, waste management requirements, and packaging restrictions create compliance obligations throughout the supply chain.

Supply chain partners’ environmental performance affects your regulatory exposure. Supplier violations can trigger regulatory scrutiny of your operations. Include environmental compliance in supplier assessment and monitoring processes.

Sustainability requirements from customers, investors, and regulators drive supply chain changes. Organizations must track environmental metrics, reduce carbon footprints, and demonstrate responsible sourcing. Effective strategies for managing supply chain risks increasingly incorporate sustainability alongside traditional operational metrics.

Natural Disaster Response and Recovery Planning

Develop detailed response plans for natural disasters affecting critical locations. Plans should address immediate safety response, damage assessment procedures, backup facility activation, and customer communication protocols.

Maintain relationships with alternative suppliers that can provide emergency capacity. Test these relationships periodically rather than discovering limitations during actual emergencies. Document activation procedures and decision triggers.

Business continuity planning for natural disasters requires realistic recovery time assumptions. Infrastructure damage may prevent facility access for extended periods. Supply chain recovery often lags behind individual facility restoration as multiple nodes must resume operations simultaneously.

Operational and Internal Risks

Operational risks originate within organizational control but can create supply chain disruption as severe as external events. Process failures, quality problems, capacity constraints, and internal communication breakdowns all threaten supply chain performance.

Equipment failures represent the most common operational risk. Manufacturing equipment, material handling systems, and transportation assets all require maintenance and eventually fail. Preventive maintenance reduces failure frequency but cannot eliminate risk entirely.

Human error contributes to many operational disruptions. Incorrect order processing, shipping errors, quality inspection failures, and procedural deviations create downstream problems. Training, process design, and verification systems reduce error rates.

Process Design and Operational Efficiency

Supply chain process design directly affects operational risk exposure. Overly complex processes create more failure points. Inadequate verification steps allow errors to propagate. Processes optimized purely for efficiency may lack resilience buffers.

Balance efficiency with resilience in process design. Just-in-time systems minimize inventory costs but increase vulnerability to supply disruption. Lean operations eliminate redundancy that could provide backup capacity during equipment failures.

Document critical processes thoroughly and train personnel comprehensively. Process documentation enables consistent execution and provides foundation for improvement. Training ensures personnel understand not just procedures but underlying logic and appropriate responses to deviations.

Quality Management and Defect Prevention

Quality problems create supply chain risk through product recalls, customer returns, and regulatory actions. Prevention costs less than detection, which costs less than correction. Systematic quality management reduces operational risk.

Implement quality controls at critical process stages rather than relying on final inspection. Early detection prevents defective material from progressing through value-added processes. Statistical process control identifies trends before defects occur.

Extend quality management through supplier networks. Supplier quality failures become your operational problems. Include quality requirements in supplier contracts. Conduct periodic audits to verify compliance. Develop supplier improvement programs rather than simply rejecting nonconforming material.

Capacity Planning and Constraint Management

Insufficient capacity creates supply chain risk through inability to meet demand fluctuations or absorb disruptions. Excess capacity wastes resources and reduces profitability. Effective capacity planning balances these competing concerns.

Identify capacity constraints throughout your supply chain. Constraints may exist in production, warehousing, transportation, or supplier operations. Understand which constraints bind under different demand scenarios.

Develop flexible capacity strategies that provide scalability without permanent fixed costs. Contract manufacturing, logistics partnerships, and variable labor models allow capacity adjustment as conditions change.

Internal Communication and Coordination

Communication failures between organizational functions create operational risk. Sales commitments without operations input, procurement decisions without demand visibility, and product launches without supply chain preparation all lead to disruption.

Implement regular cross-functional planning processes. Sales and operations planning aligns demand expectations with supply capabilities. New product introduction processes ensure supply chain readiness before launch. An essential checklist for managing supply chain risks should include formalized communication protocols.

Technology enables coordination but cannot substitute for organizational commitment. Shared systems provide information visibility. Regular meetings ensure information gets interpreted and acted upon. Executive sponsorship signals priority and ensures participation.

Cybersecurity and Technology Risks

Cybersecurity threats increasingly target supply chains through both direct attacks and indirect compromise through suppliers. Organizations often struggle to evaluate and monitor the cybersecurity posture of large numbers of suppliers. This visibility gap creates significant vulnerability.

Ransomware attacks encrypt critical systems and demand payment for restoration. These attacks can halt operations entirely. Organizations must maintain backup systems, develop restoration procedures, and implement defenses that detect attacks before encryption occurs.

Data breaches expose sensitive information including customer data, intellectual property, and competitive intelligence. Beyond immediate damage, breaches trigger regulatory investigations and customer notification requirements. Prevention requires comprehensive security programs addressing technical controls, access management, and personnel practices.

Supply Chain Cyber Attack Vectors

Attackers increasingly target supply chains rather than direct victims. Compromising a supplier with access to multiple customers amplifies attack impact. Software supply chains prove particularly vulnerable as malicious code inserted into legitimate applications spreads to all users.

Third-party access creates attack opportunities. Suppliers, logistics providers, and service vendors often require network access to perform functions. Each connection represents potential entry point for attackers.

Map all external parties with system access. Document what systems they access and what privileges they hold. Implement controls that limit access to minimum necessary levels. Monitor third-party access for anomalous activity.

Technology Dependency and System Failures

Supply chains depend increasingly on digital systems for order processing, inventory management, transportation coordination, and demand forecasting. Technology failures create operational disruption even without malicious attacks.

Software defects, infrastructure failures, and integration problems all disrupt supply chain operations. Organizations must develop technology resilience through redundant systems, backup procedures, and manual workaround capabilities.

Cloud service dependencies create new risk patterns. Service provider outages affect multiple organizations simultaneously. Understand your cloud providers’ resilience capabilities and recovery commitments. Develop contingency plans for extended service interruptions.

Data Integrity and Decision-Making Risks

Supply chain decisions rely on data accuracy. Incorrect inventory records, inaccurate demand forecasts, and flawed product information all lead to poor decisions. Data integrity problems may result from system errors, integration failures, or malicious manipulation.

Implement data validation controls that detect anomalies and inconsistencies. Reconcile data across systems regularly. Investigate discrepancies promptly rather than assuming errors are minor.

Data governance establishes ownership, quality standards, and management processes. Clear accountability ensures someone monitors data quality and addresses problems. Standards define acceptable accuracy levels and update frequencies.

Cybersecurity Mitigation Strategies

Implement layered security controls addressing network perimeter, internal systems, and endpoint devices. No single control provides complete protection. Multiple layers ensure attackers must defeat several defenses to compromise systems.

Conduct regular security assessments including penetration testing and vulnerability scanning. These assessments identify weaknesses before attackers exploit them. Prioritize remediation based on risk severity and exploitation likelihood.

Develop incident response plans that address detection, containment, eradication, and recovery. Practice these plans through tabletop exercises and simulations. Update plans based on exercise findings and emerging threats.

Supplier Risks and Performance Issues

Supplier risks encompass financial instability, quality failures, capacity constraints, delivery reliability, and relationship issues. These risks directly impact your operations regardless of internal process excellence.

Single-source suppliers create concentration risk. Organizations dependent on sole suppliers face complete disruption if that supplier fails. Financial savings from volume concentration rarely justify the vulnerability created.

Surveys of supply chain and procurement leaders for 2025 show that many organizations acknowledge significant blind spots in their understanding of supply chain risks. This visibility limitation extends particularly to supplier financial health and operational capabilities.

Supplier Selection and Qualification

Systematic supplier selection reduces future performance problems. Qualification processes should assess financial stability, quality management systems, capacity adequacy, and cultural compatibility alongside cost competitiveness.

Financial assessment identifies suppliers at risk of insolvency. Review financial statements, credit reports, and payment history. Be wary of suppliers offering prices significantly below market rates, as unsustainable pricing often signals financial distress.

Quality system audits verify supplier capability to meet specifications consistently. Look for documented processes, statistical process control, and continuous improvement programs. Strong quality systems indicate supplier commitment to excellence.

Supplier Performance Monitoring

Ongoing performance monitoring detects problems before they create crises. Track delivery reliability, quality metrics, responsiveness, and relationship health. Establish clear performance expectations and review regularly.

Leading indicators predict future problems. Increasing lead times, rising defect rates, and delayed responses to inquiries all suggest deteriorating performance. Address problems early rather than waiting for major failures.

Develop scorecards that quantify supplier performance across key dimensions. Share scores with suppliers and discuss improvement plans for underperformance. Recognize excellent performance to reinforce desired behaviors.

Supplier Diversification Strategies

Supplier diversification reduces concentration risk but increases management complexity. The optimal balance depends on risk tolerance, volume requirements, and supplier capabilities.

Maintain qualified alternative suppliers even for single-source arrangements. These alternates may receive minimal volumes but remain capable of rapid capacity expansion. The insurance value justifies the higher piece-price costs.

Geographic diversification provides resilience against regional disruptions. Suppliers in different regions face different natural disaster risks, political environments, and economic conditions. This diversity reduces likelihood of simultaneous failures.

Supplier Development and Collaboration

Supplier development programs improve supplier capabilities rather than simply switching to better performers. Investment in supplier improvement creates competitive advantage through superior supplier network performance.

Collaborative planning improves forecast accuracy and capacity alignment. Share demand projections and discuss capacity implications. Joint planning identifies potential shortfalls early when mitigation options remain available.

Long-term relationships encourage supplier investment in your business. Suppliers will dedicate capacity, invest in specialized equipment, and prioritize your orders when they view the relationship as stable and profitable. Effective strategies to mitigate supplier risk include relationship development alongside transactional controls.

Building Supply Chain Resilience Through Risk Mitigation

Supply chain resilience represents the ability to absorb disruptions, maintain operations during adverse events, and recover quickly when failures occur. Resilience differs from efficiency. Organizations must consciously balance these competing objectives.

Risk mitigation strategies reduce likelihood or impact of supply chain disruption. Effective strategies address specific risks with targeted controls rather than implementing generic resilience measures. Resource allocation should reflect risk priority based on likelihood and consequence.

The mitigation approach varies by risk category. Some risks require redundancy through backup suppliers or excess capacity. Others demand enhanced monitoring and early warning systems. Still others benefit from contractual protections or insurance transfers.

Diversification and Redundancy

Diversification reduces concentration risk across suppliers, facilities, transportation modes, and geographic regions. This strategy increases costs through smaller volumes and reduced standardization but provides insurance against single-point failures.

Maintain multiple qualified suppliers for critical materials and components. Split volume to keep alternates engaged and capable. Document switching procedures so transitions can occur quickly during disruptions.

Geographic redundancy protects against regional disruptions. Facilities in different regions provide backup capacity during local events. Understand lead time and cost implications of switching production between locations.

Inventory and Buffer Stock Strategies

Strategic inventory provides time buffer during supply disruptions. Safety stock levels should reflect lead time variability, demand uncertainty, and replenishment risk. Calculate optimal levels based on service level targets and holding costs.

Critical components warrant higher inventory levels than easily sourced commodities. Prioritize inventory investment based on supply risk and demand importance. Components with single sources and long lead times require substantial buffers.

Inventory positioning affects response capability. Centralized inventory minimizes total quantity but increases distribution time. Distributed inventory enables faster response but requires higher total investment. Match strategy to customer requirements and supply risk profile.

Enhanced Visibility and Monitoring

Supply chain visibility enables early problem detection and proactive response. Organizations should monitor supplier performance, inventory levels, transportation status, and demand signals continuously.

Implement technology systems that provide real-time visibility across the supply chain. Transportation management systems track shipment location and predict delays. Supplier portals enable performance monitoring and communication.

Leading indicators predict problems before they impact operations. Supplier financial metrics, quality trends, and capacity utilization all signal potential future disruptions. Monitor these indicators systematically and investigate deterioration promptly.

Business Continuity and Contingency Planning

Business continuity planning addresses how operations continue during disruptions. Plans should identify critical processes, document recovery procedures, and establish clear decision-making authority.

Develop scenario-specific response plans for likely disruptions. Natural disasters, supplier failures, transportation disruptions, and cybersecurity incidents each require different responses. Generic plans prove inadequate during actual events.

Test continuity plans through exercises and simulations. Testing reveals gaps, validates assumptions, and builds organizational muscle memory. Update plans based on exercise findings and changing conditions.

Risk Transfer and Insurance

Insurance transfers financial consequences of supply chain disruption to insurers. Business interruption insurance, property insurance, and specialized supply chain policies provide financial protection.

Understand policy coverage limits, exclusions, and deductibles. Many policies exclude common disruption causes or cap payments below actual exposure. Review coverage against risk assessment findings.

Contractual risk transfer shifts responsibility to suppliers or customers. Force majeure clauses, liability limitations, and indemnification provisions all allocate risk between parties. Ensure contract terms reflect intended risk allocation.

Implementing Systematic Risk Assessment Processes

Systematic risk assessment provides foundation for effective mitigation strategies. Organizations must identify potential risks, evaluate likelihood and impact, prioritize based on significance, and monitor continuously.

Risk identification begins with supply chain mapping. Document all suppliers, facilities, transportation routes, and dependencies. Map information flows, financial flows, and physical flows. This visibility reveals potential failure points.

Assessment should occur regularly, not just during crisis response. Annual assessments capture major changes while quarterly reviews address emerging risks. Trigger assessments when significant supply chain changes occur.

Risk Identification Methods

Multiple techniques help identify supply chain risks. Process mapping reveals operational risks and dependencies. Supplier audits identify financial and capability risks. Scenario analysis explores environmental and external risks.

Engage cross-functional teams in risk identification. Operations perspectives differ from procurement, quality, and finance views. Diverse participation produces more complete risk inventories.

Learn from industry experience and near-miss events. Industry associations share common risks and best practices. Internal near-misses reveal vulnerabilities before they cause actual disruptions.

Risk Evaluation and Prioritization

Evaluate each identified risk across likelihood and impact dimensions. Likelihood considers frequency and probability. Impact assesses operational, financial, and reputational consequences.

Quantify risks where possible. Financial impact estimates enable cost-benefit analysis of mitigation investments. Operational impact assessments guide resource allocation and contingency planning.

Plot risks on probability-impact matrices to identify priorities. High-likelihood, high-impact risks require immediate attention. Low-likelihood, low-impact risks may warrant monitoring only. Focus resources on significant risks that justify mitigation investment.

Risk Monitoring and Review

Risk profiles change as business conditions evolve. Monitoring processes should track both identified risks and emerging threats. Review risk assessments when supply chain changes occur or external conditions shift.

Establish key risk indicators that provide early warning of deteriorating conditions. Supplier performance trends, inventory levels, and lead time changes all signal increasing risk.

Create feedback loops that incorporate lessons from disruptions and near-misses. Post-incident reviews identify root causes and prevention opportunities. Update risk assessments and mitigation strategies based on experience.

Technology Solutions for Supply Chain Risk Management

Technology enables supply chain risk management capabilities that manual processes cannot achieve. Visibility systems, analytics platforms, and automation tools all enhance risk management effectiveness.

Supply chain visibility platforms track inventory, shipments, and supplier performance in real-time. These systems provide alerts when problems occur and enable proactive response.

Predictive analytics forecast potential disruptions based on patterns and leading indicators. Machine learning identifies correlations humans might miss. These capabilities improve from experience as systems process more data.

Risk Management Software and Platforms

Specialized supply chain risk management software provides integrated capabilities for risk identification, assessment, monitoring, and response. These platforms centralize risk information and facilitate collaboration.

Supplier management systems track supplier performance, financial health, and compliance status. Automated monitoring triggers alerts when suppliers exhibit concerning patterns.

Understanding supply chain risk management software helps organizations select appropriate tools. Evaluate solutions based on visibility capabilities, analytics sophistication, integration options, and user experience.

Data Analytics and Predictive Capabilities

Advanced analytics extract insights from supply chain data. Descriptive analytics explain what happened. Diagnostic analytics reveal why problems occurred. Predictive analytics forecast future risks.

Demand forecasting algorithms improve accuracy and reduce safety stock requirements. Transportation optimization reduces costs while maintaining service levels. Supplier risk scoring predicts failures before they occur.

Machine learning continuously improves predictions as systems process more data. These capabilities require quality data, technical expertise, and organizational commitment to data-driven decision making.

Integration and Information Sharing

Technology integration connects internal systems and enables information sharing with supply chain partners. Integration eliminates manual data entry, reduces errors, and accelerates information flow.

Electronic data interchange standardizes information exchange between organizations. Application programming interfaces enable real-time system connections. Cloud platforms facilitate collaboration without complex technical integration.

Information sharing requires trust alongside technology. Partners must believe shared information will be used appropriately and not exploited. Establish governance frameworks that define data usage and protect confidentiality.

Future Trends in Supply Chain Risk Management

Supply chain risk management continues evolving as threats change and capabilities advance. Organizations must anticipate future developments and build adaptive capabilities.

Geopolitical fragmentation will likely increase as economic nationalism grows. Organizations should develop flexible supply chains capable of adapting to changing trade relationships and regulatory requirements.

Climate change impacts will intensify, creating both gradual environmental shifts and more frequent extreme weather events. Supply chain strategies must incorporate climate adaptation and mitigation.

Digital Transformation and Emerging Technologies

Digital technologies enable new risk management capabilities while creating new vulnerabilities. Organizations must balance technology adoption benefits against cybersecurity and dependency risks.

Artificial intelligence and machine learning improve demand forecasting, risk prediction, and decision optimization. These technologies require quality data and human oversight to avoid algorithmic failures.

Blockchain provides transparency and traceability for complex supply chains. Distributed ledger technology enables verification of product authenticity, compliance documentation, and transaction history.

Regulatory Evolution and Compliance Requirements

Supply chain regulations continue expanding in scope and geographic reach. Organizations must monitor regulatory developments and adapt compliance programs proactively.

Environmental regulations increasingly require supply chain transparency and accountability. Organizations must track carbon emissions, resource consumption, and waste generation throughout supply networks.

Human rights and labor standards receive growing attention from regulators and stakeholders. Supply chains must demonstrate ethical sourcing and fair labor practices across multiple tiers.

Reshoring and Supply Chain Regionalization

Extended global supply chains face increasing scrutiny following recent disruptions. Many organizations now evaluate nearshoring and reshoring options that reduce lead times and geopolitical exposure.

Regional supply chain strategies balance cost efficiency with resilience and responsiveness. Serving regions from local production and sourcing reduces transportation costs and lead times while building flexibility.

Total cost models should incorporate risk and resilience factors alongside direct costs. Cheaper options often carry hidden costs through greater disruption vulnerability and longer recovery times.

Moving Forward with Confidence

Supply chain risk management requires systematic processes, appropriate technology, and organizational commitment. Organizations that implement robust risk management capabilities build competitive advantage through superior operational reliability.

Start with thorough risk assessment that identifies vulnerabilities across all categories. Prioritize risks based on likelihood and impact. Develop mitigation strategies that address specific risks with targeted controls.

Build supply chain resilience through diversification, inventory buffers, enhanced visibility, and business continuity planning. Test capabilities regularly through exercises and incorporate lessons from disruptions.

Your next step involves conducting a complete supply chain mapping exercise. Document all suppliers, facilities, transportation routes, and dependencies. This visibility foundation enables effective risk assessment and mitigation planning. Effective strategies for supply chain risk management build on this understanding of your specific vulnerabilities and capabilities.

Organizations that prioritize supply chain risk management maintain operations during disruptions that halt competitors. They capture market share, strengthen customer relationships, and demonstrate reliability that commands premium pricing. The investment in risk management capabilities delivers returns through avoided losses and captured opportunities.